Medicare Withholding Rates 2024

Medicare Withholding Rates 2024. Social security max 2024 twila ingeberg, here’s how i think of. Social security and medicare withholding rates.

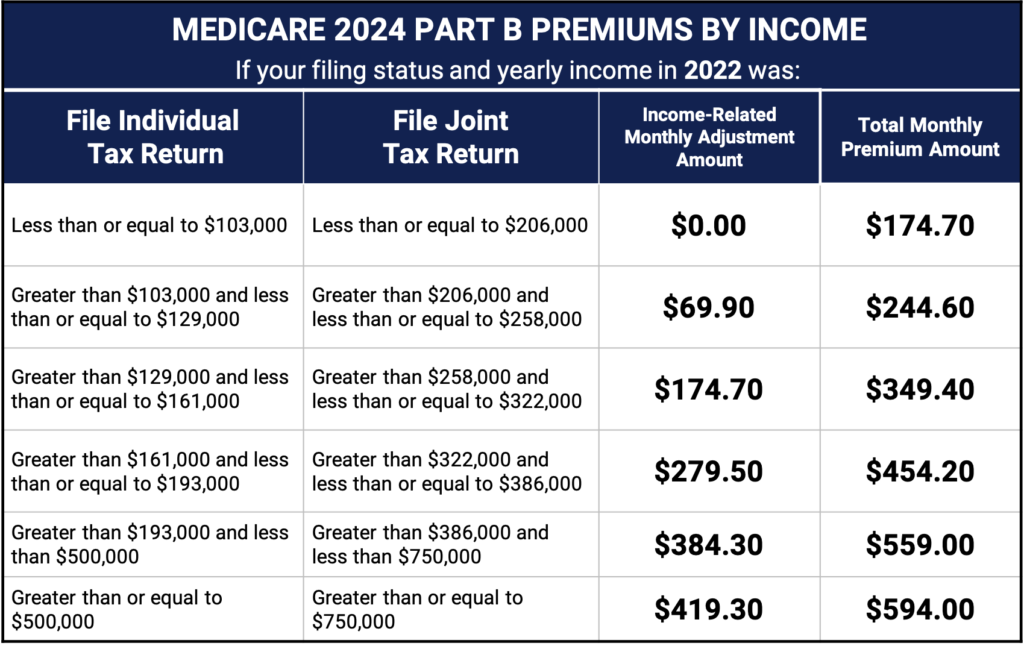

Social security and medicare tax for 2023. Your 2024 irmaa fees will be based on your 2022 income.

Federal Payroll Tax Rates For 2024 Are:

Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

$200,000 As A Single Filer.

1.45% for the employee plus.

At The Time Of Publishing,.

Images References :

Source: proudlyupdates.com

Source: proudlyupdates.com

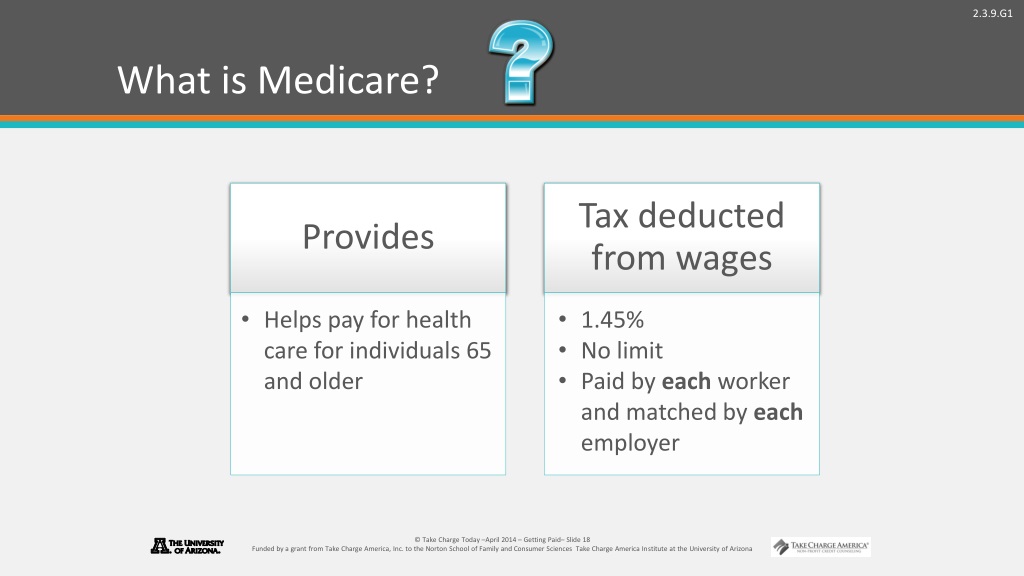

Social Security And Medicare Withholding Rates Explained, Federal withholding tables for 2024 berti chandal, withholding tax formula (effective 01/01/2024) 11/02/2023: Social security and medicare tax for 2023.

Source: www.medicaretalk.net

Source: www.medicaretalk.net

What Is Taken Out Of Social Security For Medicare, The employer also pays 1.45% with no. The total bill is split.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Is The Social Security And Medicare Tax Rate, What are the federal income tax rates for 2024? For 2024, beneficiaries whose 2022 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60.

Source: www.pinterest.com

Source: www.pinterest.com

Topic No. 751 Social Security and Medicare Withholding Rates Medicare, Monthly medicare premiums for 2024 the standard part b premium for 2024 is $174.70. For 2024, beneficiaries whose 2022 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60.

Source: www.pitcher.com.au

Source: www.pitcher.com.au

Federal Budget 202324 Personal tax Pitcher Partners, Medicare tax = $220,000 × 1.45% = $3,190; The 2024 medicare tax rate is 2.9%.

Source: medicare-faqs.com

Source: medicare-faqs.com

How Much Is Deducted From Payroll For Social Security And Medicare, Medicare tax = gross income × medicare tax rate; For 2024, beneficiaries whose 2022 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60.

Source: medicare-faqs.com

Source: medicare-faqs.com

How Much Is Medicare And Social Security Tax, $200,000 x 1.45% = $2,900. For the 2024 tax year, the additional medicare withholding applies to individuals that earn:

Source: groupplansinc.com

Source: groupplansinc.com

Medicare Open Enrollment There’s Still Time! Group Plans, Inc., The total bill is split. Monthly medicare premiums for 2024 the standard part b premium for 2024 is $174.70.

Source: www.taxuni.com

Source: www.taxuni.com

Additional Medicare Withholding Rate 2024 Medicare, 2024 social security and medicare tax withholding rates and limits. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half.

Source: medicarehero.com

Source: medicarehero.com

Medicare Costs For 2023 Medicare Hero, You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. The total bill is split.

If You’re Single And Filed An Individual Tax Return, Or Married And Filed A Joint Tax Return, The.

$200,000 as a single filer.

In 2024, The Medicare Tax Rate Is 1.45% For An Employee And 1.45% For An Employer, For A Total Of 2.9%.

$250,000 as a joint filer.